General Information of SUPER Energy Power Plant Infrastructure Fund (SUPEREIF)

| Name of the Fund (in Thai) | กองทุนรวมโครงสร้างพื้นฐานโรงไฟฟ้า ซุปเปอร์ เอนเนอร์ยี |

| Name of the Fund (in English) | SUPER Energy Power Plant Infrastructure Fund |

| Security Symbol | SUPEREIF |

| Asset Management Company | BBL Asset Management Co., Ltd. |

| Fund Supervisor | KASIKORNBANK Plc. |

| Financial Advisory for the Initial Public Offering | Bangkok Bank Plc. |

| Fund Type | It is a type of closed-end mutual fund that offers for sale of investment units to general investors, which does not accept redemption of investment units. The management company will apply for the registration of investment units to be listed securities on the SET |

| Fund Objective | To raise funds from investors. The funds being raised from these offerings will be utilized to invest mainly in infrastructure businesses related to electricity and/or alternative energy (investments being made in such infrastructure businesses, shall have capability to generate sustainable income for the Fund in order that that the Fund could make distributions to the unitholders upon a long-term basis), as well as investing in other assets, securities, and/or other instruments as permitted by the securities law. |

| Fund Life | No specific term |

| Fund Size | 5,150 million baht from initial public offering and a long-term borrowing from financial institutions in the amount of 3,000 million baht, the total amount received from fund raising by offering investment units and borrowing totaling 8,150 million baht. |

| Investment Unit Type | One type which has equal rights and benefits in all units. |

| Benefits and Policy of Dividend Payment and Capital Return Payment |

The Fund has the policy to pay dividends to the unitholders not less than twice a year except for the first calendar year period and the last calendar year period of the investment, each of which may not last a full cycle of a calendar year, in light of which the Management Company will take into account how many times per annum the dividend payment may be made during that calendar year as deemed appropriate, in the case that the Fund has a sufficient amount of retained earnings. Subject to the Securities Law, any proposed payment of dividend will be made to all unitholders from the adjusted net profit, in aggregate for each financial year, at a rate of no less than 90% of the adjusted net profit (or other rates permitted by the law upon a case-by-case basis). |

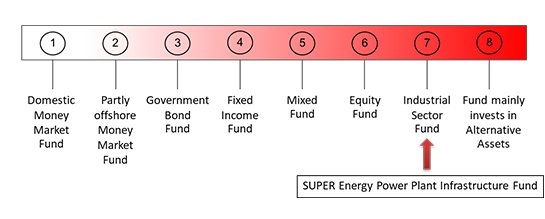

| The Fund's Risk Diagram |

The Fund’s initial investment was the Right of Net Revenue being generated from solar power plant operations owned by 17AYH and HPM. The main income of the power plants came from the sale of electricity to the state enterprise, namely PEA or MEA (as the case may be), which were reliable parties. In addition, the Power Purchase Agreements were long-term agreements. Each solar power plant had been completed constructed and had been in commercial operation for approximately 3 to 4 years. Regarding expenses for power plant management, most of the costs in managing the power plants were clearly determined in accordance with related contracts and some of them were structured as lump-sum expenses to reduce the fluctuation of Net Revenue. Moreover, with the nature of the business of generating electricity for sale to the PEA or MEA (as the case may be) according to the Power Purchase Agreements. The appearance of new solar power plant projects will not have any negative impact on the performances of solar power plants that the Fund invested in the Net Revenue as an initial investment in any way. Therefore, it was of the view that this Fund had the level of risk similar to that of the industrial fund which had a risk level of level 7. However, investors should study the information in the prospectus in detail before making a decision to invest. |

| Initial Investment of the Fund | The Right of Net Revenue being generated from a total number of 19 projects of solar power plant business with the total maximum generation capacity accounted for 118 megawatts belonging to 17AYH and HPM. The period of the Net Revenue Transfer Agreement commenced from the Investment Closing Date of the Fund, which was 14 August 2019, to the contract expiry date of each Power Purchase Agreement. 17AYH or HPM entered into a Power Purchase Agreement with Provincial Electricity Authority (PEA) and Metropolitan Electricity Authority (MEA). The remaining period of each Power Purchase Agreement (from 14 August 2019) was approximately 21-22 years. The last Power Purchase Agreement will expire on 26 December 2041. |

| Additional Investment | In addition to the investment in the Right of Net Revenue of 17AYH and HPM, the Management Company may, on behalf of the Fund, invest in other infrastructure businesses and seek benefits from those additional infrastructure assets which must be corresponsive to the objective of the Fund and in accordance with permitted securities law at that time by taking into account the benefits of the unitholders thoroughly. |

| Offering Unit | 515 million units |

| Type of Investment Unit | Name registered |

| Offering Price | 10 baht per unit |

| Minimum Subscription Amount | 2,000 units, multiples of 100 units |

| Underwriter | Bangkok Bank Plc. |

| Allocation Method | Small-lot first for general investors |

| Offering Period | 22-26 and 30 July 2019 during the business hours of the branch opening for subscription and 31 July 2019 before 3:30 pm |

| Subscription Location | All Bangkok Bank branches except micro branches |

| Guarantee | No guarantee of returns |